During the president of China’s visit to Central and Southeast Asian countries in 2013,China has put forward the policy concepts of jointly building the Silk Road Economic Belt and the 21st Century Maritime Silk Road, In the same year, the Premier of the State Council also talked about the importance of Belt and Road Initiative’s development at the ASEAN Expo. Up to now, Belt and Road Initiative has become the foundation of China’s trade development.

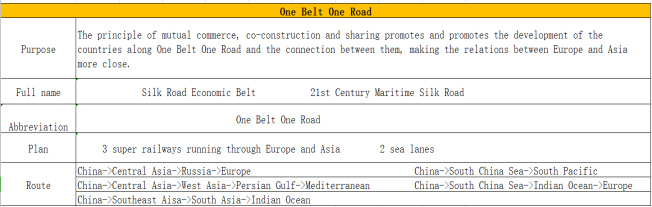

The connotation of One Belt One Road policy

In the plan jointly issued by the National Development and Reform Commission of China, the Ministry of Foreign Affairs, and the Ministry of Commerce, entitled “Vision and Action to promote the Joint Construction of the Silk Road Economic Belt and the 21st Century Maritime Silk Road,” Belt and Road Initiative is a systematic project. It can push forward the development of the countries along the Belt and Road Initiative route and the docking between each other, and make the relations between Europe,Asia and African countries closer. However, the scope of the policy, involving diverse and rich countries, Belt and Road Initiative’s promotion how to practice and which countries may be affected is something we must understand.

①One Belt One Road Route Plan

One Belt One Road spread out with China as the core and ran through Europe,Asia and Africa. The purpose of the Silk Road Economic Belt (for short: the Belt) is to build three super-railways across the Europe and Asian continent, along the way through Central Asia and West Asia. Southeast Asia and Russia end up in Europe, the Mediterranean and the Indian Ocean. The idea of the 21st Century Maritime Silk Road is to build two waterways at sea, extending to the South China Sea and the Indian Ocean and ending in the South Pacific and Europe.

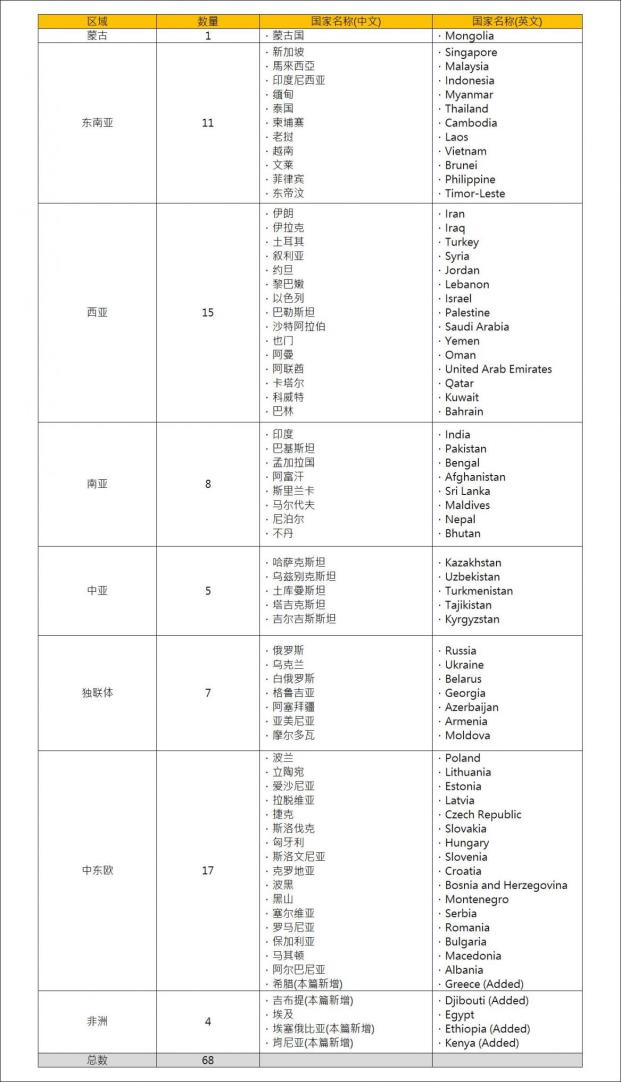

Countries along One Belt One Road

There are 64+1 countries along the route of One Belt One Road(+1 is China).Across the three continents of Europe, Asia and Africa.Across the three continents of Europe, Asia and Africa. However, at present, more and more countries are willing to invest in One Belt One Road development. In order to make the countries along the routes as far as possible so that the potential photovoltaic demand can be seen, this article is based on One Belt One Road economic route. In recent years, some countries that actively participated in Belt and Road Initiative’s construction and recently signed cooperation agreements have also been included in the discussion, namely, Djibouti in Africa and Kenya. Ethiopia and Greece, which signed a memorandum of understanding with China on One Belt One Road cooperation in August, totaled 68+1 countries along the route.

②One Belt One Road proposal for New Energy

The promotion of One Belt One Road not only focuses on trade and economy, but also on the promotion of new energy sources in the context of policy considerations. The following points are mentioned in the article “Vision and action for promoting the co-construction of the Silk Road Economic Belt and the 21st Century Maritime Silk Road”

- Actively promote clean, renewable energy cooperation in hydropower, nuclear power, wind power, solar energy, etc.

- Strengthen energy resources processing technology, equipment and engineering services cooperation

- Promoting the construction of cross-border power and transmission channels

- Actively launch cooperation on upgrading and upgrading of regional power grids

From the above-mentioned proposals for new energy, One Belt One Road can be expected to plan to make the energy (including electricity and oil) of the countries along the whole line to be effectively dredged between countries, and hope to promote the energy upgrade of various countries and enhance the effectiveness of these countries.

The present situation of Photovoltaic Development along the area of One Belt One Road Countries.

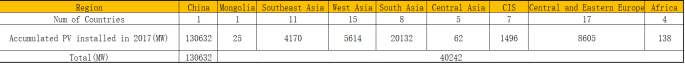

①Cumulative PV installation in the area along the route

From 2015 to 2017, global PV installations are growing year by year. However, focusing on the countries along One Belt One Road route, we will find that the cumulative PV installation volume in these countries has increased from 18GW in 2015 to 40.2 GW in 2017, and that in 2015-2017 the cumulative PV installation volume in these countries has increased from 40.2 GW in 2015 to 40.2 GW in 2017. The cumulative installation growth rate of 123% was significantly higher than that of 75.62% of the global cumulative installation rate.

The share of cumulative photovoltaic installations in countries along One Belt One Road route also rose to 10.36 percent, up from 8.27 percent in 2015, and China’s 130.63GW share rose to 44 percent. The PV installation volume of the countries along the line of Belt and Road Initiative (including China) accounts for nearly 1/2 of the world’s demand, highlighting the pivotal influence of the countries along the Belt and Road Initiative route on the development of the global photovoltaic industry.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

②Photovoltaic installation capacity in countries along One Belt One Road route

This paper divides the countries along the route into eight major regions: Mongolia, Southeast Asia, West Asia, South Asia, Central Asia, CIS, Central and Eastern Europe, and Africa. However, not every region has a growing trend of photovoltaic installations. In addition, growth dynamics vary from region to region, some of which are driven by increased demand from a single country in the region , where growth is driven by increased demand from a single country in the region (e.g. Turkey in West Asia and India in South Asia). However, there are also other regions by a number of countries to promote the development of photovoltaic industry and then accumulate together.

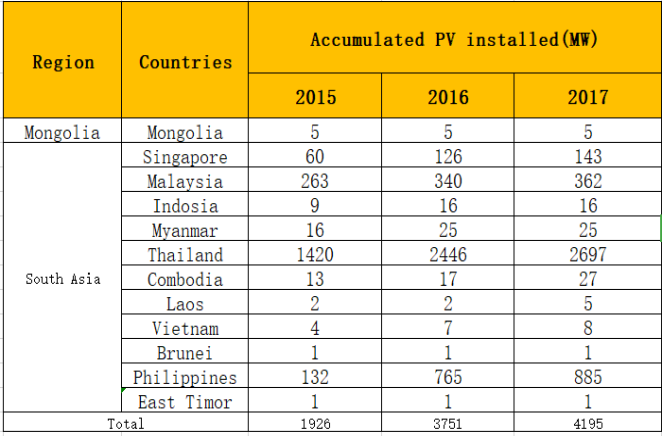

1. Cumulative PV installation in 11 countries of Southeast Asia and Mongolia

The rapid economic development in Southeast Asia in recent years has been expected by the outside world. In addition, Southeast Asian countries are in a tropical region with sufficient light, with an annual sunshine amount of 1460 to 1900kWh per square meter. Under this natural advantage, photovoltaic development is also expected by the outside world.

In 2017, the cumulative installation volume in Southeast Asia and Mongolia reached 4195 MW, and all 11 countries in Southeast Asia, except East Timor, are members of the ASEAN, in order to promote the development of renewable energy. ASEAN has decided that renewable energy should account for 23% of the total energy supply by 2025. On the other hand, in the energy planning blueprint for 2025, the optimal PV installation will reach 55 GW, following this logic. In the future (including 2018), Asean countries will need to achieve the PV installation capacity of 7.26GW every year, which also highlights that the market still has a lot of potential and space for development.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

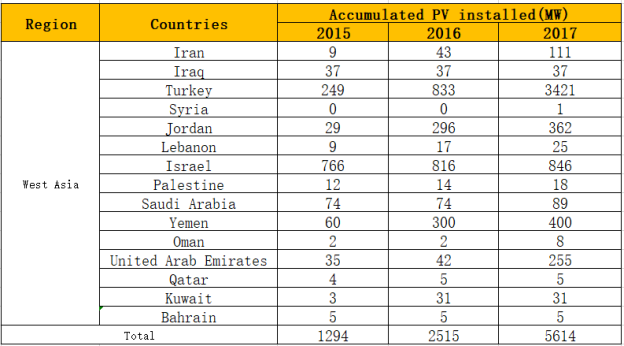

2. Cumulative PV installation in 15 countries of Western Asia

The economic situation of the countries of the Western Asia region is very different, and some countries, such as Iran and Saudi Arabia, rely on oil to maintain economic sources, thus obtaining better economic development opportunities than other Western countries, However, part of that country, such as Syria and Yemen, have been affected by the war in the long year and have not yet been able to get rid of the haze and damage of the war.

In terms of the development of the photovoltaic industry, the cumulative PV installation volume in the whole Western Asia region in 2017 reached 5614 MW, among which Turkey developed most rapidly, and the cumulative installation volume reached 3.4 GW by 2017, accounting for 60.9% of the accumulated installation volume in the West Asia region in that year. But other countries have not made Turkey more beautiful than before, and many countries in Western Asia are well aware of the importance of renewable energy development and, therefore, have drawn up plans for the future of renewable energy development. Photovoltaic plays an important role in national renewable energy development plans.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

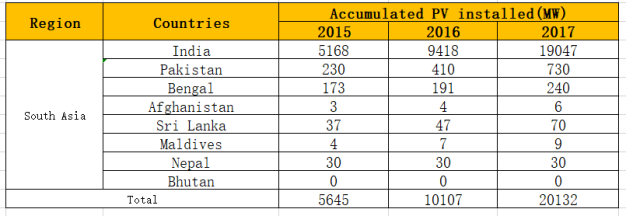

3. Cumulative installation of 8 countries in South Asia

The average GDP growth rate of the G-8 countries in South Asia in 2017 was 6.058%, and some countries’ outstanding performance in GDP was due to finding ways to maintain stable growth, such as Maldives and Nepal committed to promoting the tourism industry. Bhutan’s hydraulic development and Bangladesh’s textile industry, etc.

In the development of the photovoltaic industry, the cumulative installed capacity of photovoltaics in South Asia in 2017 reached 20,132 MW, and the cumulative growth rate of PV installations reached 256.63% in 2015-2017. The main growth driver is that the development of the Indian market is large and fast, 2017 The cumulative installed capacity in the Indian market has reached 19GW, accounting for 94.61% of the total installed capacity in South Asia in 2017. India is also known as the second largest PV market in the world after China.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

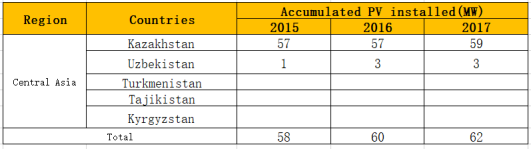

4. Cumulative PV installations in five countries in Central Asia

The Central Asian countries have high expectations for the One Belt One Road and hope to drive the economic growth of the entire Central Asian region and the development of the country through the Belt and Road. At present, the main products of the five Central Asian countries are natural resources such as cotton, natural gas, aluminum ore and oil. Exports depend on neighboring countries such as Russia, China or the countries of the five Central Asian countries.

The total PV installations in the five countries of Central Asia have accumulated to only 62 MW in 2017. At present, the development of photovoltaics in Kazakhstan is the most prominent. The cumulative installed capacity in 2017 is 59 MW. The estimated PV in the country has an annual total energy consumption.5% potential.

On the other hand, Uzbekistan began to implement economic reforms in 2017. Not only has it opened up foreign exchanges, but it has also eliminated export restrictions. The photovoltaic sector has set a target of 450MW for installation in 2025. However, Turkmenistan, Tajikistan and Kyrgyzstan have not made any mark on the photovoltaic industry.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

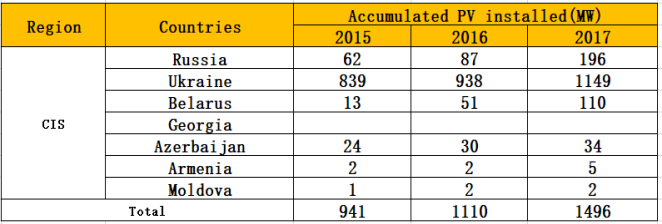

5. Cumulative PV installation in 7 CIS countries

Most CIS countries have focused on agriculture and industry, such as wine rich in Moldova and Georgia, Armenia’s focus on mineral exports and Russia’s oil supply and industrial processing. On the other hand, the political and economic tensions between Ukraine and Russia have also attracted international attention in recent years.

The total PV cumulative installation of the CIS countries in 2017 is 1,496 MW, of which Russia and Ukraine are the most important, both of which are 196MW and 1,149MW in 2017, accounting for 89.9% of the cumulative PV installation in 2017 for the whole of the CIS countries, It can be said to include the photovoltaic development of the whole Commonwealth of Independent States.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

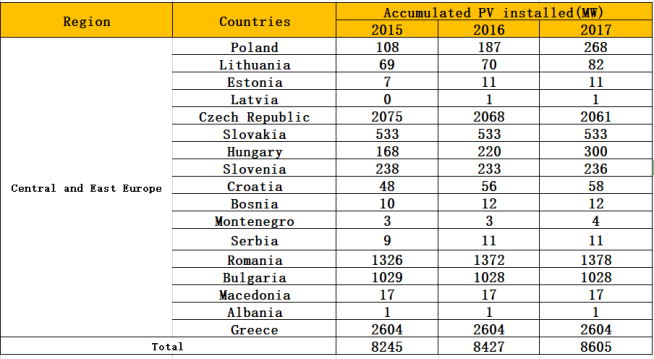

6. Cumulative installation in 17 Central and Eastern European countries

Europe has gradually stepped out of the haze of European debt crisis, compared with mature Western European countries such as Germany, France, Central and Eastern European countries’ economic development potential and speed is more amazing and expected.

In photovoltaic development, the cumulative installation volume of photovoltaic in Central and Eastern Europe reached 8605MW in 2017, and the cumulative installation growth rate in 2015 / 2017 was 4.36%. Although Bulgaria, among the 17 countries in Central and Eastern Europe, Photovoltaic developments in countries such as the Czech Republic and Slovakia have stagnated and Estonia, Latvia, Croatia, Bosnia and Herzegovina, Montenegro, Serbia and Albania have not been involved in the photovoltaic industry. But there are still other countries, such as Poland, Lithuania, Hungary and Slovenia, which support the development of photovoltaic industry in Central and Eastern Europe, and they are also pushing up 2015 / 2. The reason for the growth of PV installation volume in 017. Greece is still affected by the European debt crisis, but has formulated relevant policies for the development of photovoltaic industry.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

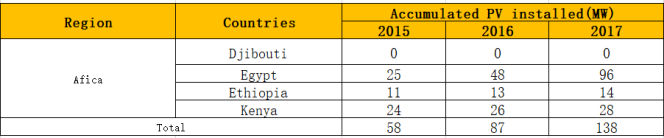

7. Cumulative PV installation of four African countries

One Belt One Road travels through just four countries in Africa, but most of them are highly developed countries such as Egypt, Ethiopia and Kenya.

The solar photovoltaic cumulative installation capacity of the four countries in Africa in 2017 is 138 MW, in which Egypt and Ethiopia are of great concern, and Egypt is currently building the world’s largest photovoltaic industrial park, Benban Solar Park, which is expected to contribute nearly 2 GW of installation capacity in 2019. Ethiopia has set out a PV project plan for the period 2016-2020. If the development plans of both countries can be successfully implemented and implemented, the future development of PV installation in Africa will be better than the current state.

Source: from IRENA RENEWABLE CAPACITY STATISTICS 2018

Summary:

One Belt One Road policy map spans 68 countries across the three major Europe and Asian states and is still on the increase. At the same time, all the countries along the routes can be classified by region to understand the dynamics and potential of photovoltaic industry development in each region.

Among the Southeast Asian countries, Malaysia, Thailand, Vietnam and the Philippines are the most highly anticipated markets. Take Vietnam and Thailand for example, both have set targets for the future development of the photovoltaic industry, and Vietnam has set a PV installation volume of 12GW by 2030. Thailand, on the other hand, achieved 6GW PV installation in 2036. Both countries have also introduced FiT and Net Metering policies aimed at stimulating the development of the national local photovoltaic industry.

Several countries in Western Asia have put in place plans to develop renewable energy and photovoltaic, such as Jordan to achieve 600MW PV installation by 2020 and Saudi Arabia to achieve wind and photovoltaic-based 9.5GW renewable energy installation by 2023. All highlight the determination to develop renewable energy. However, Saudi Arabia announced in October that it had shelved plans for a $200 billion photovoltaic project in cooperation with Softbank Corp., and it was reported that Saudi Arabia was developing a broader strategic plan for renewable energy. This action for Saudi Arabia renewable energy and even photovoltaic development trend has a variable, its impact Time remains to be seen. Compared with other Western Asian countries photovoltaic development is the best for Turkey. Turkey’s main push has been to allow people to install photovoltaic projects below 1MW without authorization, which has led to a surge in demand for PV installations in Turkey, but it has also prompted the Turkish government to do so. Consideration should be given to how to increase the installed capacity of large photovoltaic power stations. On the other hand, the recent revaluation of the country’s currency, the lira, highlights the risk of economic instability in Turkey, and thus threatens to slow down the country’s photovoltaic installations in the future.

The development of the photovoltaic industry in Central Asia is preferably Kazakhstan, and is currently in cooperation with the European Bank for Reconstruction and Development (EBRD) and is receiving the financing of the bank to help Kazakhstan build photovoltaic power stations in multiple regions.

South Asia is also one of the world’s most concerned photovoltaic markets in recent years. India’s policy goal is to achieve 100GW installation by 2022. In order to achieve this goal, India’s PV installations will grow year by year in 2015-2017. However, the August launch of the (Safeguard), a safeguard tariff, is expected to slow India’s demand for installation.

The most high-profile CIS countries are Russia and Ukraine. Among them, Russia also set a PV installation target of 1.52GW by 2024, in order to accelerate the achievement of the target. Russia has launched a renewable energy bid for a total of 1.25GW last year and a renewable energy tender for 2.8GW this year, with photovoltaic installations of 150MW and 625.2020MW, respectively. It can be seen from this that the government’s determination to develop renewable energy and promote the photovoltaic industry, the future development of the Russian photovoltaic market is worth looking forward to.

In addition to Bosnia and Herzegovina, Montenegro, Serbia, Macedonia and Albania, the Central and Eastern European countries have set up a target of 20 per cent of the overall energy demand for renewable energy by 2020, In order to achieve the goal, the EU has set different standards for renewable energy for Member States, taking Poland as an example, and Poland has set a target of 15 per cent of total energy consumption by 2020. In the light of the development of the photovoltaic industry, Poland is one of the countries in the 17 countries of Central and Eastern Europe with positive growth, and the main driving policy of Poland is the Auction and the self-generation. Droumer.

Egypt, which has the largest PV development in four African countries, plans to make up 20% of total electricity installed capacity by 2020, including photovoltaic as a renewable energy source. Egypt’s photovoltaic policy relies mainly on FiT,. However, Egypt is actively looking for ways to gradually transfer the original FiT subsidy system to the auction (Auction) system.

The Belt and Road began in 2013 to the time that it has been promoted for up to five years, and the “Silk Road Economic Belt” and the “21-th Century Maritime Silk Road”, which were to be built, are now in the process of sustainable development. The return to the photovoltaic industry itself, along with the policy of the one-way policy, the photovoltaic industry generally holds a positive attitude, and the chairman of the company, Qu Xiaoyan, said that “One Belt and One Road” is very important to the photovoltaic industry, and by 2025, more than half of the PV new installation opportunities are in the “One Belt and One Road”. “One Belt and One Road” brings new market growth space and international cloth for Chinese photovoltaic enterprises Bureau, broke the previous market dependence on Europe, the United States and Japan and the situation of low-cost competition. Overall, Belt and Road Initiative provides a platform to help PV enterprises expand the market and promote cooperation with other countries. If Belt and Road Initiative’s policies are implemented smoothly in the future, the development of the global photovoltaic industry will be on the next floor.

In the future, PV Infoink will launch a series of national photovoltaic thematic reports every two weeks for countries along the road, with the aim of helping our partners, as well as the advanced in the photovoltaic industry, to find new opportunities for the development of the new PV industry in the future, The whole photovoltaic industry can move towards a good and prosperous direction.